Promo code "00LAYOUTS"

Bank Security Safeguarding: Keynote Charts for Financial Fortification

In an era where cyber threats loom large over financial institutions, presenting security strategies effectively is crucial for building stakeholder confidence. Our Bank Security Safeguarding Keynote Charts template rises to this challenge, offering 59 editable slides that demystify complex security frameworks. Tailored for commercial banks, credit unions, investment firms, and mortgage lenders, this template transforms technical data into clear, persuasive visuals.

From illustrating robust access controls to mapping out incident response plans, these charts help you communicate how your institution stays ahead of risks. Drawing on expertise from cybersecurity leaders like those at Deloitte and PwC, who stress the importance of visual aids in compliance training, this template ensures your presentations are both authoritative and engaging. It's not just about data - it's about demonstrating a commitment to safeguarding assets, aligning with standards like PCI DSS and GDPR for trustworthiness.

Fortifying Your Message with Specialized Security Visuals

Effective communication in banking security demands visuals that cut through jargon. This template provides just that, with charts designed to showcase layered defenses. For example, use flowchart slides to depict transaction monitoring processes, highlighting anomalies in real-time data streams.

Customization is key in a field as dynamic as bank security. Adjust slide elements to reflect your institution's protocols - change icons from locks to shields, or recolor graphs to match corporate branding. This adaptability allows for seamless integration into board meetings or staff training sessions, where clarity can prevent breaches costing millions, as noted in IBM's Cost of a Data Breach reports.

Essential Features for Comprehensive Coverage

- Intelligent Fraud Detection Charts: Pie and donut visuals to break down fraud types, from phishing to insider threats.

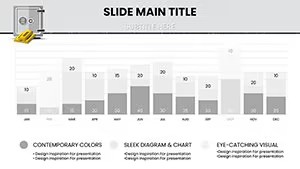

- Real-Time Monitoring Dashboards: Line and area graphs tracking transaction volumes and alert triggers.

- Incident Response Timelines: Gantt-style slides outlining steps from detection to resolution.

- Customizable Protocols: Modular elements for tailoring to specific regulations like SOX or Basel III.

- High-Security Icons: Vector graphics of firewalls, encryption keys, and biometric scans for visual reinforcement.

These features draw from proven methodologies in cybersecurity presentations, ensuring your content resonates with audiences from executives to auditors.

Practical Use Cases in Financial Security

Envision a compliance officer using this template to present annual risk assessments. A radar chart could compare vulnerability scores across branches, pinpointing areas for improvement and justifying budget allocations. In real-world scenarios, firms like JPMorgan Chase have used similar visuals to streamline audit processes, reducing preparation time by up to 30%.

For investment firms, leverage heatmaps to visualize threat landscapes, such as geographic risks in global operations. This aids in strategic planning, like enhancing defenses against ransomware, a growing concern per FBI reports. Credit unions can adapt slides for member education, simplifying concepts like two-factor authentication through step-by-step infographics.

Workflow Integration: Building Your Secure Presentation

- Assess Your Needs: Identify key security topics, like access controls, and select corresponding slides.

- Populate with Data: Input metrics from your SIEM systems into editable charts for accuracy.

- Enhance Visuals: Add animations to simulate threat pathways, making abstract risks tangible.

- Review for Compliance: Ensure alignments with standards; add footnotes for sources like NIST guidelines.

- Deliver with Confidence: Practice transitions to maintain flow in high-stakes meetings.

This process integrates with tools like Keynote's collaboration features, ideal for team-based security reviews.

Superior to Standard Tools: Why Choose This Template

Basic Keynote offers charts, but lacks the niche focus for bank security. Our template includes pre-configured elements like risk matrix grids, saving time over starting from scratch. Compared to generic options, it incorporates LSI terms like "cyber threat intelligence" or "endpoint protection," enhancing discoverability in searches.

In practice, users find it boosts engagement - think a before-and-after comparison where bland text becomes a compelling Sankey diagram of data flows. Feedback from platforms like LinkedIn's cybersecurity groups underscores its value in professional settings.

Pro Tips for Impactful Security Presentations

Layer your narrative: Begin with overview slides on threat evolution, then drill down into specifics like fraud algorithms. Use color coding - red for high risks, green for safeguards - to guide attention. For virtual sessions, embed hyperlinks to resources like CISA alerts, adding depth without clutter.

Emphasize trustworthiness by including case studies, such as how similar visuals aided recovery in the Equifax breach aftermath. Keep paragraphs concise, under 100 words, to maintain pace in time-sensitive briefings.

Secure Your Edge in Banking Today

With rising threats, don't compromise on presentation quality. Our Bank Security Safeguarding Keynote Charts template equips you to convey protection strategies convincingly. From fraud prevention to compliance, these 59 slides fortify your message. Take the next step - customize and present with assurance now.

Frequently Asked Questions

- How customizable are the security protocols in the slides?

- Highly customizable; edit text, icons, and data to match your institution's specific frameworks.

- Does it support real-time data integration?

- Yes, input live metrics into charts for up-to-date presentations.

- Is it suitable for non-banking financial entities?

- Absolutely, adaptable for credit unions, lenders, and firms beyond traditional banks.

- What file format is provided?

- .key for Keynote, with export options to other formats.

- Can it be used for training purposes?

- Yes, interactive elements make it perfect for staff education on security best practices.

- Are updates available?

- Check our site for future enhancements based on evolving threats.