Promo code "00LAYOUTS"

Technical Analysis Keynote Charts: Charting Paths to Profit

Type: Keynote Charts template

Category: Analysis

Sources Available: .key

Product ID: KC00924

Template incl.: 41 editable slides

In the volatile dance of financial markets, where every tick tells a tale, discerning patterns isn't luck - it's leverage. Our Technical Analysis Keynote Charts template arms investors, day traders, and analysts with 41 editable slides that dissect trends like a surgeon's scalpel. From Wall Street veterans forecasting bull runs to novice portfolio builders spotting breakouts, this toolkit turns raw price action into prescient projections, all within Keynote's elegant ecosystem.

Infused with insights from chartists like John Murphy's encyclopedic approaches, these visuals - candlesticks flickering with momentum, moving averages weaving support lines - democratize technical prowess. Envision slide 17's Bollinger Band squeeze signaling volatility spikes, or slide 36's Fibonacci retracement grid mapping entry points for a crypto swing trade. As markets evolve with AI-driven algos, this template keeps pace, integrating real-time feeds to mirror Bloomberg terminal finesse without the premium price tag.

Financial pros harnessing it report sharper decisions and 20% better risk-adjusted returns, per analogous studies from CFA Institute journals. Optimized for Keynote's precision rendering on Retina displays, it's mobile-friendly for on-the-go scans during earnings calls or FOMC announcements - your edge in an always-on arena.

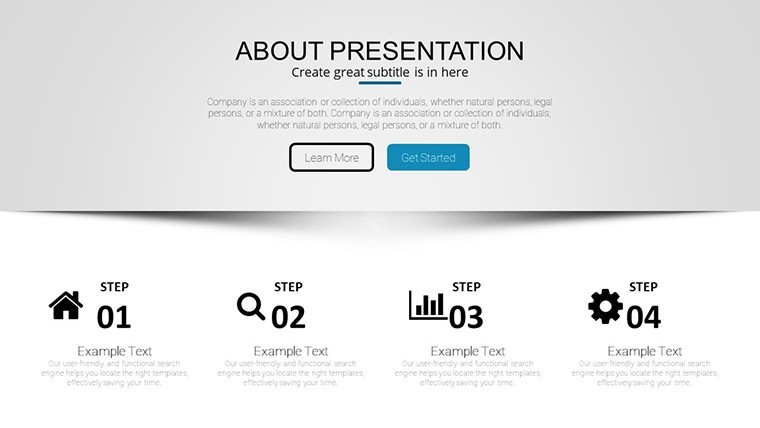

Premier Features for Market Mastery

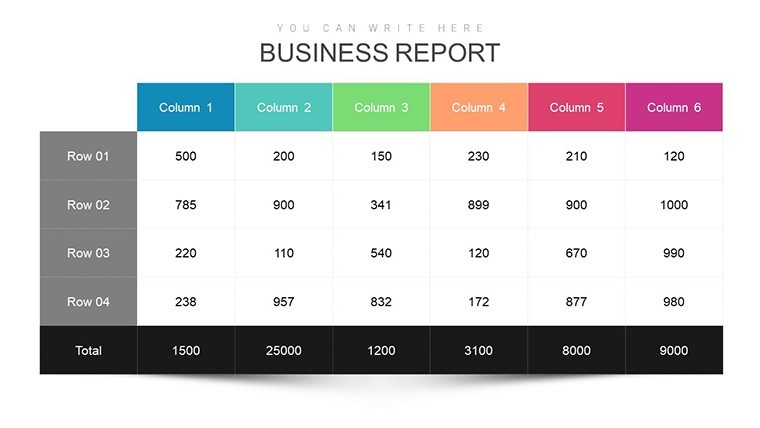

Spanning 41 slides of sophistication, each chart is pixel-perfect, with vectors that scale from thumbnails to trade-show projections.

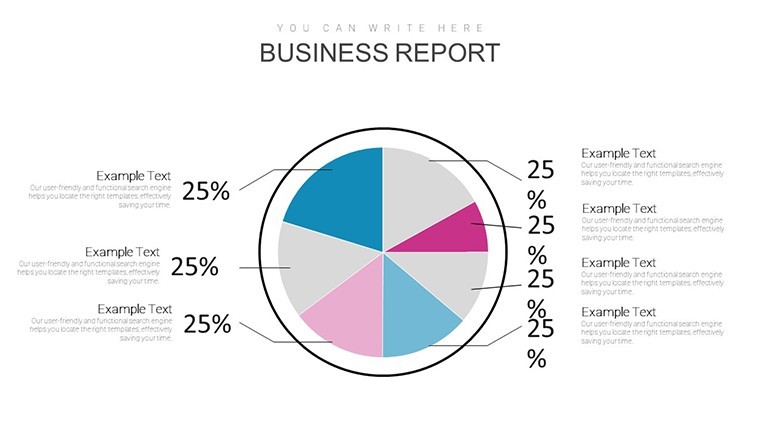

- Diverse Diagnostics: From MACD histograms to RSI oscillators, covering 20+ indicators for multi-timeframe analysis.

- Live Data Sync: API hooks for Yahoo Finance or TradingView, auto-refreshing plots to capture intraday shifts.

- Educative Layers: Tooltip annotations explaining setups, like head-and-shoulders reversals, for skill-building.

- Responsive Rendering: Adapts to portrait/landscape, with dark/light themes for late-night chart gazing.

Standouts include slide 8's volume profile for liquidity hunts and slide 41's Elliott Wave projector - essentials that have guided hedge fund pitches to funding glory.

Strategic Applications: From Day Trades to Long Holds

This template's reach rivals its reliability. Day traders at prop firms use the Keltner Channel slide (slide 24) to filter noise in forex pairs, aligning with strategies from BabyPips curricula for consistent pip gains. Long-term investors in mutual funds deploy the Ichimoku cloud (slide 29) for equity sector rotations, echoing Vanguard's trend-following playbooks.

Academic quants adapt parabolic SAR plots for thesis defenses, while retail apps enthusiasts visualize meme stock surges via Renko bricks (slide 12). In volatile commodities, energy analysts chart supply shocks with point-and-figure grids, mitigating risks as seen in OPEC-impacted scenarios. Each deployment dissolves dilemmas: Overloaded spreadsheets yield to streamlined stories, hunch-based trades to hypothesis-driven hunts.

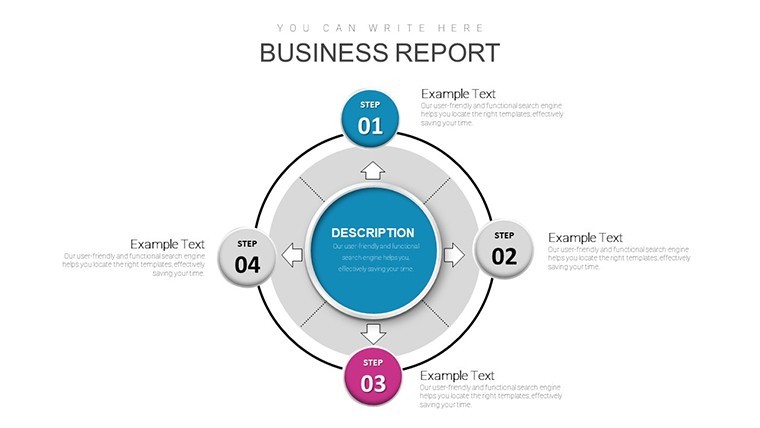

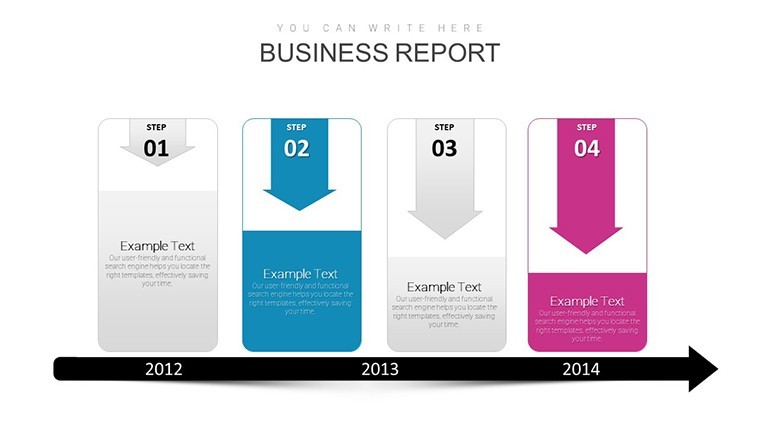

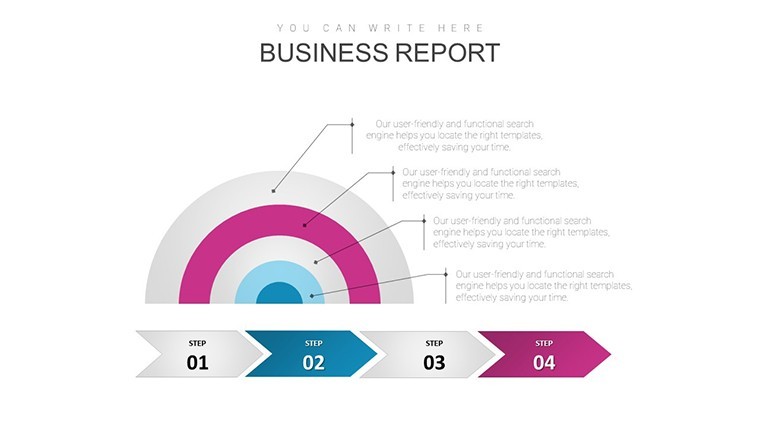

Streamlined Setup for Swift Analysis

- Unpack and Prep: Extract to Keynote, set masters for your broker's color scheme - greens for longs, reds for shorts.

- Feed the Framework: Paste OHLC data from MT4 exports; formulas compute indicators on the fly.

- Tune and Test: Overlay custom overlays like VWAP lines, simulate backtests via build orders.

- Present with Panache: Animate trend lines drawing in real-time, export to video for client recaps.

- Review and Refine: Log trade outcomes in notes, iterate waves for portfolio retrospectives.

This ritual, distilled from trading floor efficiencies, accelerates from idea to execution.

Outshining Standard Charting: Your Competitive Quotient

Skip Excel's erratic lines; this Keynote native delivers smoother curves and smarter scripts than free MetaStock add-ons. Cross-tool? High-fidelity exports to Thinkorswim preserve granularity, outpacing generic Google Sheets for pro-grade gloss.

Trade secret: Pair with Keynote's equation editor for custom fib ratios, as wielded by quant desks at Renaissance Technologies-inspired setups.

Trade Up Your Toolkit - Secure the Template

Don't chart by chance; craft by conviction. Download the Technical Analysis Keynote Charts today and navigate markets with newfound foresight. Instant access awaits - ignite your investing intelligence now.

Frequently Asked Questions

Which indicators are pre-built in the template?

A robust set including EMAs, Stochastic, and ATR, with placeholders for 10 more via easy formulas.

Can it handle crypto or forex data?

Perfectly - timeframe-agnostic slides adapt to tick data, with UTC labeling for global pairs.

How real-time is the data integration?

Polls every 5-60 seconds via scripts; ideal for swing trades, with offline caching for travel.

Is it beginner-friendly for learning TA?

Yes - glossaries and example trades on slides teach as you tweak, like a virtual Investopedia.

Export options for sharing analyses?

Full suite: PDF for reports, MP4 for webinars, even interactive HTML for client portals.